Proprietary access to UHNW $30M+ who bring capital, networks, and transformative expertise.

1,800+ UHNW engagements

19 Years Expertise in UHNW Data, Communication and Negotiation.

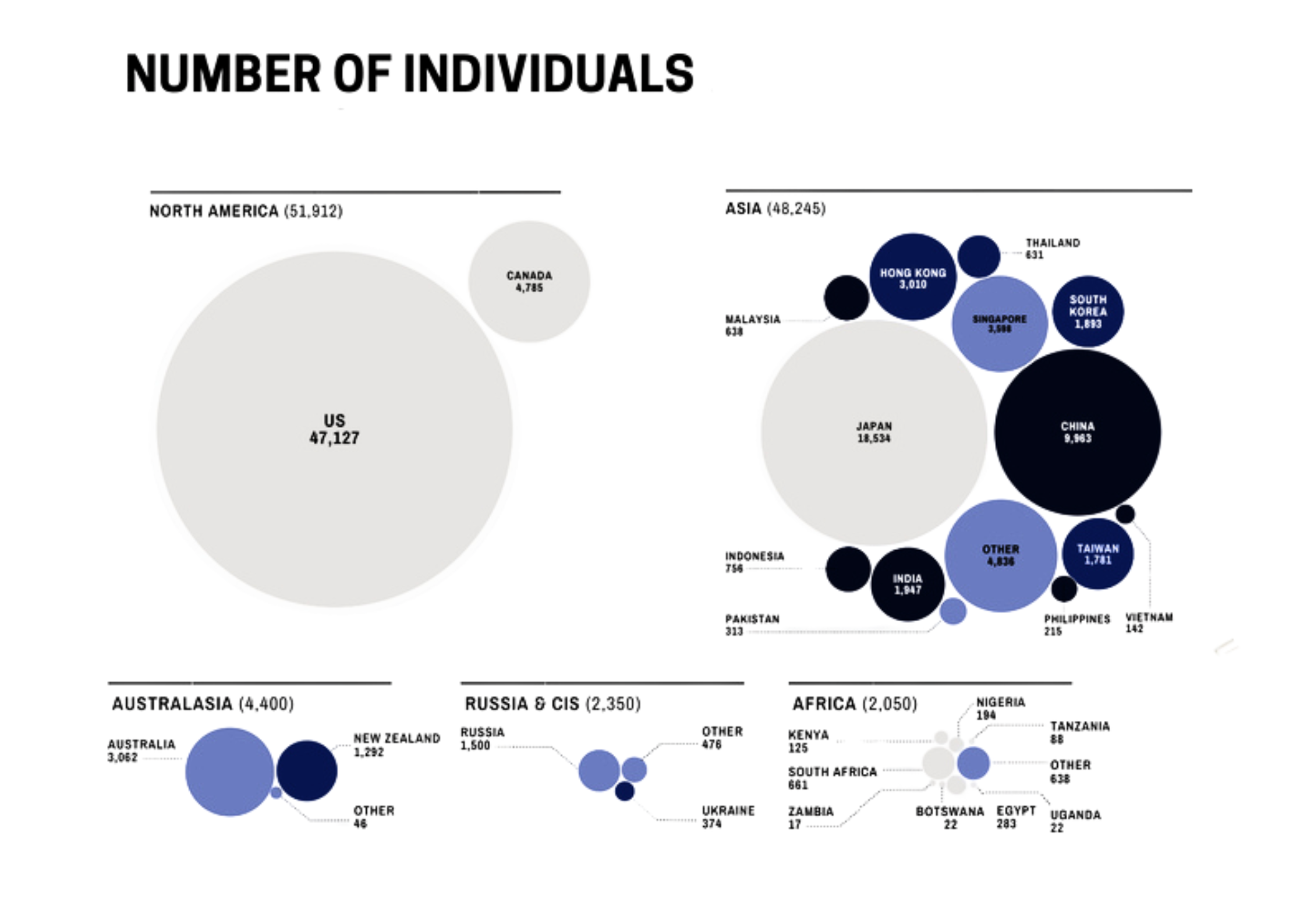

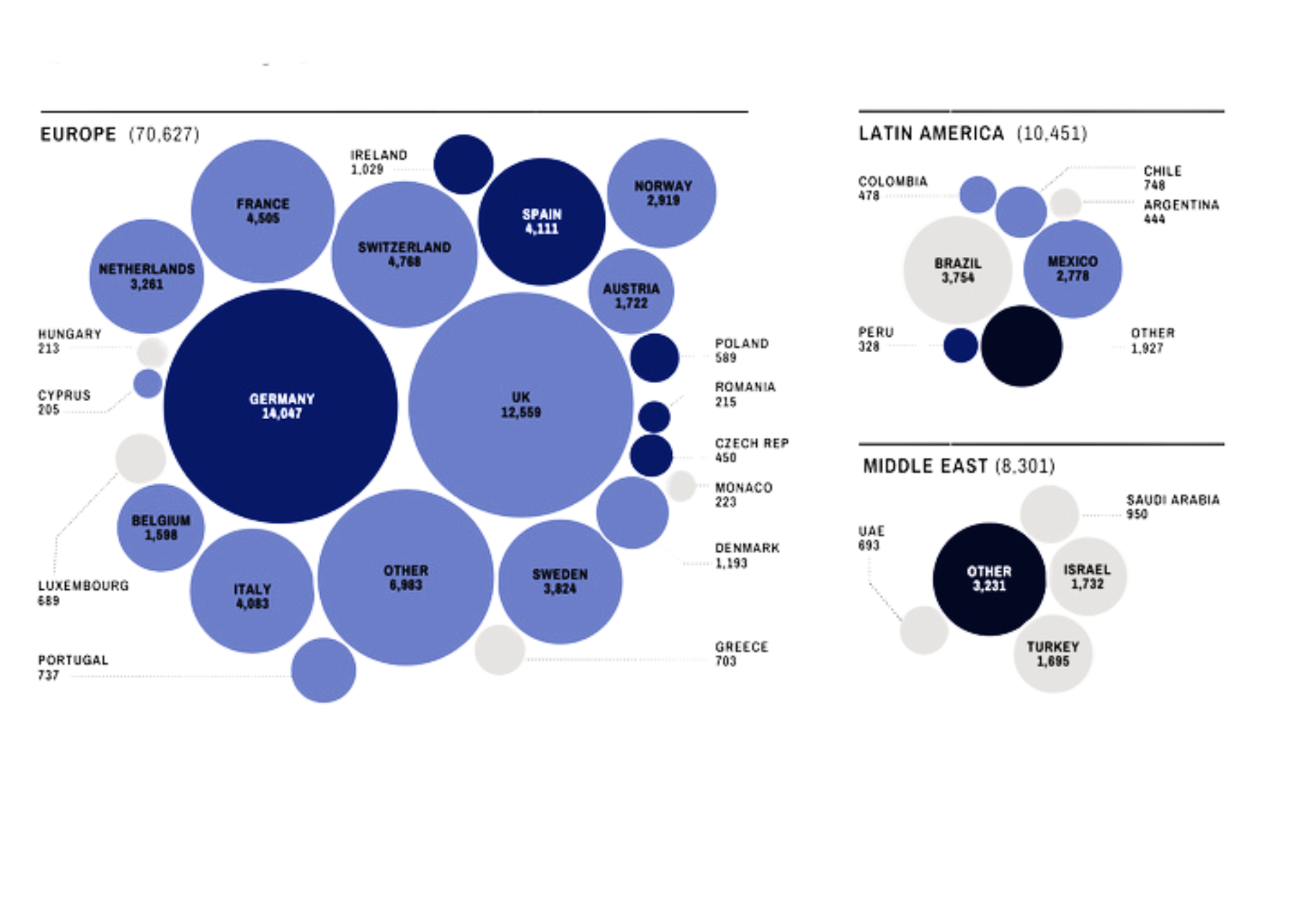

300,000 verified UHNW investors globally

For the CEO who is ready for the next stage of growth—without public fundraising noise.

This is designed for CEOs who want to :

Secure investment capital from UHNW individuals and family capital

Gain access to UHNW networks, judgement, and pattern recognition

Work with investors who understand the CEO journey—because they have built and scaled themselves

Private access to UHNW capital—structured, discreet, and controlled.

We support ambitious European CEOs raising €1M–€100M with curated UHNW investor identification, decision‑maker mapping, and introductions—handled with the discretion you would expect from a private bank.

With a targeted database of 300,000 individuals and an extensive address book, we have the means to reach out to the right investors. Furthermore, our personal contacts with over 1,800 UHNW individuals provide an added advantage in establishing meaningful connections.

The UHNW Relationship Network

Our expertise across Private Capital Solutions, Real Estate, and Private Equity

We are intimately familiar with UHNW priorities, preferred approach, and the structural trends currently shaping their allocations.

Our engagement style is discreet, relationship-driven, and grounded in trust and precision.

We understand how UHNW expect to be approached and how conviction can be established efficiently and credibly.

This depth of insight, cultivated through our longstanding network, enables us to mobilize capital with clarity and discipline.

Fit Criteria, Who We Help Best

Our focus: €1M–€100M

This is where UHNW and family capital can be highly effective, and where precision sourcing creates real advantage.

Above €100M

You are often better served by a global investment bank with distribution at that scale, for example: Goldman Sachs , J.P. Morgan, Morgan Stanley

Not the right match :

Pre‑revenue, concept-only situations or no commercial traction and no credible near‑term path to it.

UHNW investors contribute four structural advantages

Network Access & Deal Flow

UHNW investors provide more than liquidity. They offer introductions to industry leaders, co-investors, strategic partners, and governance advisors. Their network is a second balance sheet—one that cannot be replicated through public capital markets.

Exclusive Opportunities & Privileged Access

UHNW counterparties participate in allocation-constrained opportunities unavailable to retail or institutional investors: pre-IPO placements, private real estate syndicates, distressed asset repositioning, and structured co-investments in high-growth sectors. Building sustainable businesses takes time, and they are willing to provide the necessary support and resources for growth over the long run.

Risk Intelligence & Operational Experience

UHNW principals have built, scaled, and exited enterprises. They calculate risk not through models, but through pattern recognition earned over decades. Their involvement brings strategic discipline, not just capital.

Patient Capital & Long-Term Alignment

Unlike institutional mandates driven by fund cycles, UHNW investors operate on generational time horizons. They prioritize sustainable growth over quarterly performance—an alignment that protects your strategic vision.

Twenty Years of Private Capital Experience

Our practice is rooted in two decades of direct engagement with Ultra-High-Net-Worth principals. We began in the private aviation sector—managing the sale and lease of executive aircraft. This was not a transactional business; it was a trust-based operation requiring discretion, technical precision, and sustained relationships with family offices and private wealth holders.

Evolution into Capital Markets

As our network matured, a pattern emerged: our clients—UHNW individuals and their offices—began requesting access to investment opportunities beyond aviation. They valued the quality of our sourcing, our understanding of their decision-making processes, and our ability to operate without unnecessary intermediaries.

Over the past decade, we formalized this into a dedicated mandate: the structured marketing and distribution of private investment opportunities to UHNW counterparties across Europe. Our experience spans equity transactions, private debt placements, and bespoke capital structures.

Frim Background & Credentials

Evolution of UHNW Capital Across the world

The global wealth architecture is hierarchical:

While 29 million hold high net worth (€1M–€5M) and 3.5 million qualify as very high net worth (€5M–€30M), only 398,000 Ultra-High-Net-Worth principals (€30M–€1B) operate with the capacity, networks, and long-term vision required for transformational partnerships. We focus there

398,000 UHNW Individuals have between 30 Million and 1 Billion

3.5 Million VHNW Individuals have between 5 Million and 30 Million

29 Million HNW Individuals have between 1 Million and 5 Million

Scale-Ups - Investment Funds - Buyouts - Luxury Goods & Brands - Real Estate

Results, Timeline & Process

Exceptional outcomes can occur within 14 days—however, this is not the norm. A disciplined process typically involves:

Preparation & set‑up: several weeks, within a few months, depending on fit, materials, and market timing

Our tailored campaigns typically can generate:

20–30 qualified investor interests on average

50–80+ for longer-term initiatives (events, brand positioning, product introductions)

In certain niche, high-ticket sectors (e.g., jets, yachts), outcomes may be achieved with two to three precisely matched counterparties—because the correct fit matters more than volume

World-Class Endorsements

Discover case studies and testimonials from our esteemed clients